A Guide to Diverse Property Investments: Learn and Grow

Understanding Smithfield House - Prices from £220k

Location: Digbeth, Birmingham

Key Points to Consider:

- Major Regeneration Site: Smithfield House lies in the huge Smithfield regeneration site, which is just a 5 to 10 minute walk away from the city centre where attractions such as the Bull Ring shopping mall, Birminghan New Street sation and the new HS2 high speed rail station are located.

- Modern Living: The development offers contemporary apartments equipped with modern amenities.

- Community Focus: It promotes a vibrant community lifestyle with excellent transport links and local amenities.

Educational Insight: The Digbeth area which sits immediately to the south side of the city centre is undergoing a major transformation, from being an industrial area to a modern neigbourhood attracting many new digital and media companies, including the BBC.

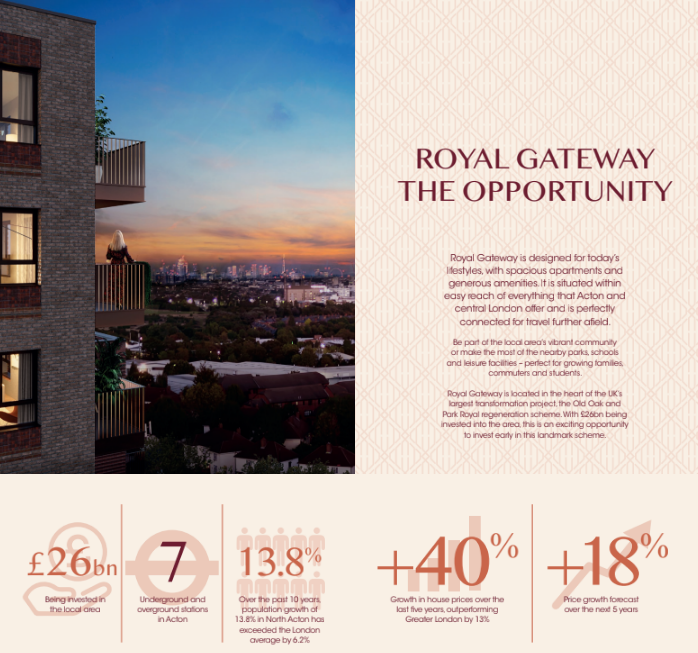

The Potential of Royal Gateway - Price from £467k

Location: North Acton, London

Key Points to Consider:

- Transportation hub: Royal Gateway offers luxurious apartments and retail spaces in a rapidly developing area.

- Regeneration site: The Old Oak Common area in North Acton is part of a major regeneration project which will include the UK’s largest transportation hub, promising high rental yields and capital appreciation.

Educational Insight: Regeneration areas typically offer substantial growth potential as they attract businesses, improve infrastructure, and enhance living standards, all adding value to the surrounding area.

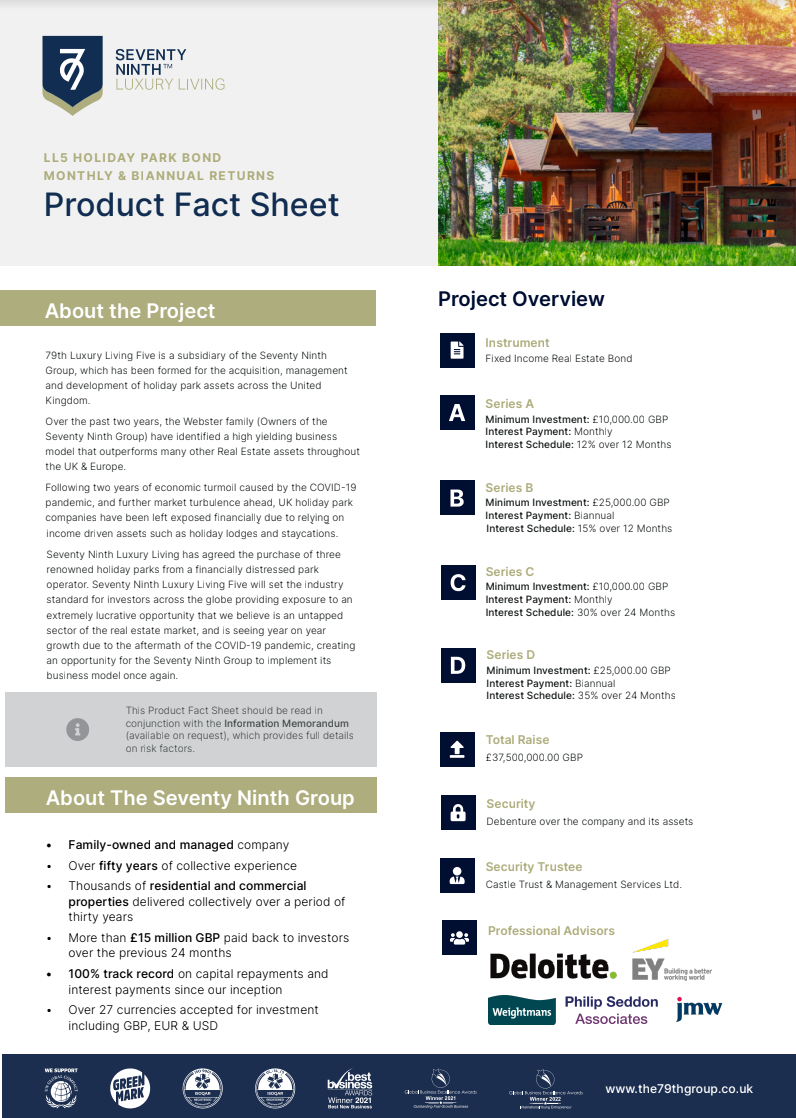

Diverse Investment with 79th Luxury Living Bonds - Starting from £10k

Options:

- Holiday Parks Bond: Capitalize on the growing tourism industry with steady returns from UK holiday parks.

- Commercial Property Bond: Secure a diversified commercial bond designed for stability and high yields.

Educational Insight: Diversifying your investment portfolio across different sectors can mitigate risk and ensure more stable returns. These one year investments offer between 12-17% annualized returns, and are secured by way of a first charge on the developers projects.

The Alderley Group - Social Housing Investment Starting from £10k

Focus: UK Social Housing Property Bond

Key Points to Consider:

- Social Impact: Invest in supported living for vulnerable adults, addressing the UK’s huge housing shortage for those who have fallen on hard times.

- Attractive Returns: The bond offers stable returns of between 12-17% per annum, while contributing to society in a meaingful way.

Educational Insight: Social impact investing not only provides financial returns but also creates positive societal change, aligning with growing ethical investment trends.

Yield Investing - Government guranteed social housing and supported living - freehold property prices start from £100k offering 9% net yields

Focus: Specialized Supported Housing for vulnerable adults, such as physically or mentally handicapped, domestic violence families, senior citizens with no other family support are just a few demographic groups benefitting from this

Key Points to Consider:

- Government Backing: Supported housing investments are backed by government funding, ensuring reliability of rent, adjusted each year based on inflation. Whats more, there are no voide periods, repair and maintenace costs or service charges to pay.

- Community Support: These investments provide stable homes for vulnerable people, enhancing community welfare and positively impacting society.

Educational Insight: Government-backed investments offer an added layer of security and come with long-term 25 year leases with no break clause, making them a sound choice for risk-averse investors wanting to secure long term inflation hedged income.

Conclusion:

At Turn-keyinvestments, we are committed to providing you with the knowledge and resources to make informed investment decisions.

Each of these opportunities presents a unique chance to grow your portfolio while contributing to community development and sustainability.

If you would like to learn more about any of these opportunities or discuss how they can fit into your investment strategy, please feel free to reach out. We’re here to guide you every step of the way.

Thank you for taking the time to explore these options. Let’s work together to achieve your financial goals through smart, informed investing.